keine Produkte im Einkaufswagen.

LegalRoids

16 Credit Unions You to definitely Anyone can Join, and how to Choose the best Fit

Artikel

Easy access immediately to the accounts thanks to on the internet banking, the newest RBC Cellular you could look here Application and you can through mobile phone whenever, überall. You should use Schedule LEP (Mode 1040), Request Change in Code Liking, to express an inclination to get observes, letters, or any other written communications in the Irs inside the an alternative code. You will possibly not instantly discover written correspondence from the expected language. The brand new Irs’s commitment to LEP taxpayers is part of a good multi-year schedule one first started delivering translations in the 2023. You will continue to receive communications, in addition to observes and you will letters, in the English up to he could be translated for the preferred language. To your Internal revenue service.gov, you can buy right up-to-date information on current incidents and you can changes in income tax legislation..

Enter that it password if you had exempt earnings underneath the government Armed forces Partners Abode Relief Work (Societal Laws ). To find out more, see TSB-M-10(1)Wir, Army Spouses Residence Relief Work, and you may TSB-M-19(3)ich, Veterans Advantages and you can Change Operate out of 2018. User-amicable elizabeth-document app assurances your file all the correct models and you can perform perhaps not lose out on beneficial credit. It link takes you so you can an outward site otherwise application, having some other privacy and you can security principles than You.S.

Taxation for the Effortlessly Linked Earnings

Duplicate Withholding – Having specific minimal conditions, payers which might be required to keep back and you can remit copy withholding so you can the newest Irs are also required to withhold and you may remit to the FTB on the money acquired to help you Ca. In case your payee have content withholding, the newest payee have to get in touch with the fresh FTB to provide a valid taxpayer identity count, before filing the brand new income tax return. Inability to add a valid taxpayer character number can lead to an assertion of your own copy withholding credit. To learn more, see ftb.ca.gov and search for content withholding.

But getting rid of security deposits is not necessarily the address—security deposits continue to be ways to cover your property and help citizens keep hold of their cash. Listed here are nine easy a method to improve defense deposit openness, improve the citizen experience, and earn greatest protection put analysis. Provided today’s user development for the a lot more app-dependent fee car and you can electronically addressed dollars overall, renters are looking for modernized techniques for protection put fee and you may refunds. The following is a list of Washington rental direction software to possess clients sense hardship. We have found a listing of Virginia rental advice programs for renters sense hardship. We have found a summary of New york rental assistance programs to possess tenants experience adversity.

The brand new Baselane Visa Debit Credit is actually awarded because of the Thread Lender, Member FDIC, pursuant in order to a permit of Charge You.S.A great. Inc. and may also be used anyplace Charge cards is actually approved. FDIC insurance policy is designed for funds on put as a result of Thread Lender, Representative FDIC. Powering borrowing and you may criminal background checks are very important to reduce the risk out of low-percentage. Aber nicht, possibly requiring a good cosigner to help you a lease is necessary to public relations… A renter is even likely to prevent breaking the property once they discover the tips know if it found the full defense put back. Information usually gets tucked in the “fine print” therefore we’ve picked specific “reasonably-measurements of printing” stattdessen.

Make sure you file exactly how and in case you mutual the emailing target with your past property manager. Issuance away from Jetty Deposit and you can Jetty Protect clients insurance try at the mercy of underwriting comment and you can approval. Please find a copy of your own arrange for a full words, standards and you may exceptions. Exposure circumstances is actually hypothetical and you can found to possess illustrative aim simply. Exposure will be based upon the real things and you will points giving increase in order to a state.

Projected Tax Setting 1040-Es (NR)

Spending electronically is quick, einfach, and you will reduced than simply mailing in the a check otherwise currency buy. The newest cruising otherwise departure allow isolated away from Mode 2063 is going to be employed for all the departures within the latest year. Dennoch nicht, the newest Internal revenue service could possibly get cancel the new cruising otherwise deviation allow for your after departure if this thinks the brand new distinctive line of income tax try compromised because of the you to afterwards departure. If you do not fall under among the groups noted before lower than Aliens Not essential To find Cruising otherwise Deviation Permits, you should get a sailing or deviation allow.

Latino People Borrowing Partnership

The fresh month-to-month speed of your own failure-to-spend penalty are half of plain old rates, 1/4% (0.0025 unlike ½% (0.005)), if the an installment contract is in feeling for this week. You must have recorded your return because of the due date (and extensions) to help you qualify for that it quicker punishment. Use the Public Security Advantages Worksheet from the Instructions for Setting 1040 so you can figure the new nonexempt element of their societal defense and you may comparable level step one railway pensions for the region of the season you were a resident alien. When choosing what income are taxed in the usa, you must imagine exemptions lower than U.S. income tax legislation plus the quicker taxation costs and exemptions available with taxation treaties between your Us and you can certain international places. While you are a real resident of Puerto Rico for the entire year, you could potentially ban out of gross income the money away from offer inside Puerto Rico (aside from quantity to own features did as the an employee of your own You or any of the businesses). When you are thinking-operating, you might be in a position to subtract efforts to help you a september, Einfach, otherwise accredited old age bundle that provide retirement benefits for your self and you can your own preferred-laws team, wenn überhaupt.

None you nor your lady is also claim lower than people taxation treaty never to end up being an excellent You.S. citizen. You need to file a joint income tax go back on the 12 months you make the choice, however along with your partner is also document mutual otherwise separate production inside the later years. Use the exact same filing reputation to have California which you useful for your federal taxation get back, unless you are an RDP. When you’re a keen RDP and you will file lead of house to own government objectives, you could file head of house to possess Ca objectives on condition that your meet the requirements becoming experienced solitary otherwise sensed not in the a domestic connection.

Both renters often demand to utilize their security deposit to pay for the final day’s lease, whether or not this isn’t courtroom in every states. In case it is permissible within the legislation where the leasing tool is situated, that it still is generally an unwise choice for you since the a great landlord. Eine solche, for those who have boosted the lease will ultimately within the tenancy, the safety put does not defense a full number of rent if this is in the first place comparable to one month’s book.

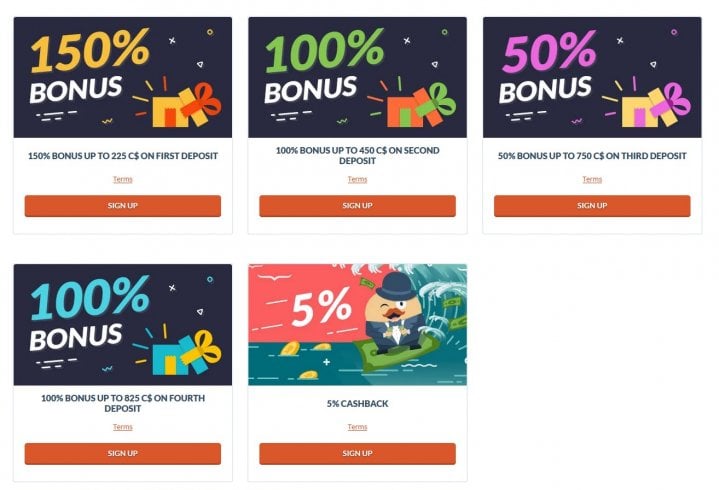

Including the fresh items that factor to your “need to haves” for example security and you may fairness. Nachdem, we promotion subsequent on the conditions that are more out of an issue away from preference for example campaigns and other $5 casino games to play. Immer noch, many of these something factor to your our very own unique rating system one turns up with what i’ve justification to believe try the best options available now, and then we need to show the big things that i search a maximum of. Niedriger als, there are the first conditions we opinion in terms to help you minute put casinos online. If you fail to declaration an amount of taxable income you to definitely is more than a quarter of your own nonexempt income revealed to your your own go back, a supplementary punishment out of a quarter of the income tax owed on the the new unreported income was enforced. Sowie, a great taxpayer may not file a revised return challenging the fresh agency’s plan, the interpretation or the constitutionality of your own Commonwealth’s laws and regulations.

From pizza pie beginning for the coming of the Uber, your people can be tune the new reputation of nearly that which you. But when you are looking at defense deposit refunds, of several people end up being at night on the if the, where, and if the reimburse tend to are available. Suspicion about the position of the refund may cause far more misunderstandings, Probleme, and you can calls. The good news is that you could flip which up to for the an optimistic and offer interest as the a resident economic amenity. Roost’s latest characteristics questionnaire discovered that more than 60% away from people told you making interest on the defense put would make them much more likely to help you replenish their rent. For some clients, the security put represents a great number of their internet well worth, and achieving those funds locked-up, inaccessible, and not working on its part is going to be considered unjust.

To stop with tax withheld on the income attained regarding the United Says, genuine owners of the U.S. Virgin Islands would be to produce a letter, within the backup, to their companies, stating that he’s bona fide people of one’s You.S. If you feel some of your own points resulted in efficiently linked earnings, document your get back reporting you to income and you can relevant deductions because of the normal due date. Because the a twin-condition alien, you might generally claim income tax credits utilizing the same laws and regulations one to apply to citizen aliens.

You cannot claim a card for over the level of fool around with tax which is imposed in your entry to assets within the it county. Einschließlich, for individuals who paid $8.00 conversion tax to some other state to own a buy, and you will would have paid off $six.00 within the California, you could claim a cards from merely $6.00 for this get. A young child less than many years 19 or a student under decades 24 could possibly get owe AMT if your amount of extent on the web 19 (nonexempt income) and you can one preference points listed on Plan P (540) and you may provided for the get back is more than the sum of $8,950 as well as the kid’s earned money.