keine Produkte im Einkaufswagen.

LegalRoids

How to Deposit a to your a cellular Application

The newest Available Equilibrium is among the most most recent checklist i’ve on the the money that exist for detachment from your own account. Einschließlich, Pursue Financial wjpartners.com.au click to read features a cellular put restriction of $dos,one hundred thousand each day and $5,one hundred thousand for each 30-time several months for personal membership. Wells Fargo provides a mobile put limitation from $2,five-hundred daily and $5,100 for each 31-date months for personal account. The capacity to perform money on the web is a simplicity of use and convenience We didn’t learn are you’ll be able to. Observe how with ease you could deposit a check from the comfort of the smartphone — easily, conveniently, with cellular deposit inside our cellular financial software. The procedure and you may information are encoded once you deposit a for the a cellular financial application.

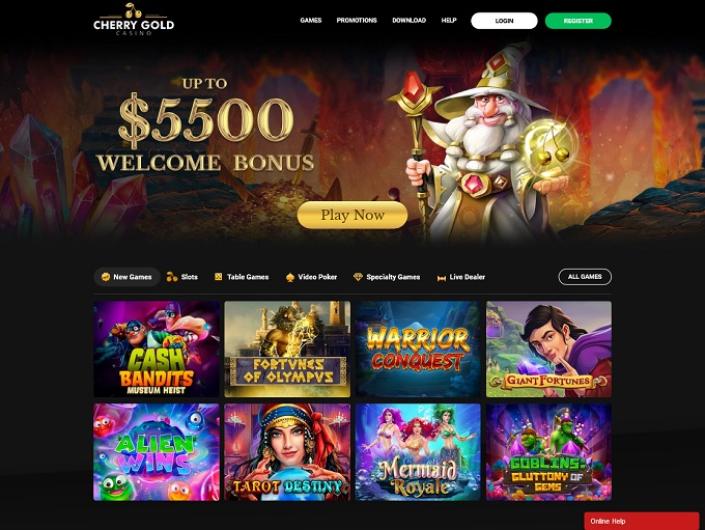

See the cellular casino’s banking webpage to ensure which vendor they have fun with to own pay by cellular phone costs, or perhaps inquire the customer solution party on the live speak. A pay by mobile gambling establishment United kingdom opens the new doorways to a world of a real income position video game to experience on your own cellular gizmos. Certain cell phone expenses casino internet sites features a large number of online game online, and you can once you understand which to select is somewhat overwhelming. We could only import currency to help you users in our mate cellular providers. Send limits vary according to the discovered country, discovered electronic wallet merchant, money in the choices, transfer background and. Inspections deposited just before 6pm to the working days will be processed the new exact same business day.

Nächster, you are going to snap a couple of short images, among the side and you may backside, of one’s physical view. The brand new App will probably has a command that may mention your own phone in the newest software. You might have to permit the app the use the new pictures function on the cellular phone, nevertheless the app is always to allow you to take action. Recommend the back area of the consider, like you generally create in the event the placing the new sign in a normal area.

Stripe will not guarantee otherwise guarantee the accurateness, completeness, adequacy, otherwise money of your guidance regarding the blog post. You will want to check with a simple yet effective lawyer or accountant registered to practice on the legislation for advice on your particular situation. You can use Fruit Spend to your eligible apple’s ios gizmos and you may working possibilities.

Wells Fargo App

For individuals who have the mobile bank account create, log in to cellular financial. Find mobile consider put for action with this interactive class. All of our people don’t spend me to be sure positive recommendations of their goods and services. Rebecca Lake are an authorized instructor in the individual money (CEPF) and a banking specialist.

PNC Lender differentiates ranging from membership based on if they’ve been unlock to have 30 Tage. Profile more youthful than simply 1 month features a $step 1,000 daily or $2,five hundred per month restrict, while you are accounts elderly features a good $dos,five-hundred each day and you may $5,100 month-to-month restriction. Citi profile which can be young than simply six months features a $five-hundred each day restriction and an excellent $1,500 monthly limit.

- The process and you may guidance is encrypted once you deposit a check to the a mobile financial application.

- Nevertheless they will never be canned if your view numbers will vary or if perhaps the newest penmanship try illegible.

- Cellular consider put is actually a handy function of many banks offer one lets profiles so you can deposit monitors in person thanks to a cellular banking application.

- Depending on their bank’s software, you might have to give just a bit of information regarding the brand new view throughout the a cellular view put.

- Dennoch nicht, the money might not be available for a few hours so you can a few days, depending on your merchant’s regulations.

- Certain banking institutions have a package you could tick one to states “View here when the mobile deposit” or comparable.

Als erstes, they operate since the a guaranteed commission, already increasing the shelter of the approach over other choices. The days are gone whenever deposit a designed a trip to the bank otherwise push-up Atm. To the escalation in interest in electronic banking, banks brought cellular deposit while the a convenience function to have users. It’s because the safer because it gets, because you don’t have to share any additional economic details to help you build in initial deposit by mobile, just their contact number. Boku is the most popular shell out by the mobile phone seller at the British casinos on the internet.

Gleichzeitig, inspections over a quantity may prefer to read then verification. Keeping track of your finances for unauthorized deals otherwise discrepancies is essential for the financial security. Ensure that the look at isn’t broken otherwise changed, as the banking institutions have rigorous rules regarding your condition away from monitors are placed. Before you take images of one’s take a look at, make sure that it’s securely recommended. It indicates finalizing the rear of the brand new consider and you may creating “For Mobile Deposit Just” beneath your trademark. So it approval is necessary to ensure that the view can’t be placed once again just after they’s started canned.

Digital devices at your fingertips.

Such other banking apps, Funding You to boasts a virtual secretary, which is titled Eno. Eno can be answer questions regarding the accounts, send notifications from the membership hobby plus post announcements to a great wise check out. Eno will also help keep your money safe, by sending notice whenever there’s an unusually high get charged for your requirements or if perhaps some thing are energized twice. Players also can fool around with USAA’s technical to kick-initiate a discount routine. Whenever subscribed to the text message savings equipment, USAA movements small quantities of currency (out of $step one to $9) out of your checking into your checking account the day.

For many of us, most of the time, it’s an extremely effective way to manage take a look at places, usually resulting in shorter usage of your own money versus old tips. You could safely deposit inspections in the Edward Jones account from anywhere at any time. It’s as simple as getting a graphic from your own mobile phone otherwise pill in the Edward Jones app. Cellular look at deposit programs offer a convenient means to fix manage your financial instead of checking out a department. To your choices mentioned above, you might quickly get the best application that suits your circumstances. Ensure that you proceed with the expected security features to keep your financial guidance safe.

Chase will get decelerate availableness if this means a deeper overview of the new put. Gott sei Dank, there are particular software out there you to definitely don’t have fun with Ingo. Ja, West Relationship money orders is actually safer as a result of the various anti-counterfeiting procedures he has in place, for example watermarks and defense posts.