No hay productos en el carrito.

LegalRoids

Stablecoins: Significado, The way they Works, and Types

It’s probably the reason why stablecoins today are mainly accustomed get and change almost every other cryptocurrencies for example bitcoin, by ease in which they can be transformed into dollars. Central organizations typically issue her or him and provide openness as a result of audits. Every type has an alternative mechanism for keeping its peg and you may making sure rates stability. Since the crypto environment develops, knowledge stablecoins is vital for everyone trying to take part in electronic financing sensibly.

⚙ Just how Stablecoins Work – what does it mean to throw your back out

The new failure destroyed more than $60 billion and you can open the risks of counting strictly for the formulas. This can be titled depegging — whenever a great stablecoin’s rate falls lower than or goes up over the property value the brand new investment it’s designed to tune. This guide reduces everything you need to discover — what is a stablecoin, the way it’s useful for costs, exchange, y más. And if your’lso are an amateur or perhaps seeking stand advised, here’s the freeze direction on the crypto’s most stable investment. The purchase out of USDCs having foreign organization might require the newest hiring, by customer, of forex transactions having organizations registered to operate on the Brazilian forex. The customer understands Circle doesn’t work in the newest Brazilian forex and won’t provide services linked to it.

Far more from Financing & business economics

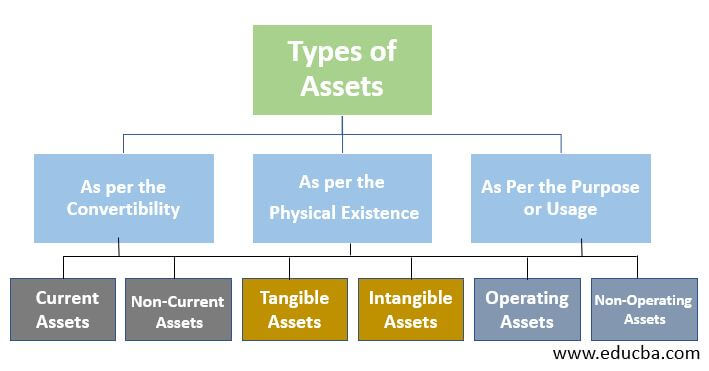

Fiat-backed stablecoins might be replaced for the transfers and therefore are redeemable of the new issuer. The soundness of your own stablecoin matches the cost of maintaining the new support set-aside and also the cost of legal compliance, permits, auditors, as well as the team structure necessary for the brand new regulator. Stablecoins try cryptocurrencies which have a good peg to many other property, such fiat money or commodities kept inside the reserve. The brand new function of them should be to create a good crypto advantage with reduced speed volatility, leading them to best for usage in the purchases.

Threats and you can Demands out of Stablecoins

Tal, in the event the Company B features $ten billion of the stablecoin within the flow, they’ll need to hold $10 billion or maybe more in the silver within their reserves on the stablecoin becoming usable. Stablecoins try held and you will replaced to your decentralized systems (called blockchains) one to serve as ledgers of the many purchases. No single mediator is needed for a couple of parties to transact within the crypto possessions.

Fidelity Crypto

Governments worldwide is actually drafting crisper regulations, looking to balance invention and you will consumer shelter from the crypto globe. Central Financial Digital Currencies (CBDCs) you will take on otherwise complement what does it mean to throw your back out stablecoins, with regards to the area. Each one of these stablecoins takes on a crucial role in keeping the brand new crypto segments effective and you will steady. In this publication, clients usually get a very clear and student-amicable understanding of exactly what a good stablecoin is actually, the way it works, and exactly why it takes on for example a life threatening role in the wide electronic cost savings. Whether you are a new comer to crypto or trying to deepen your knowledge, this article will supply the base needed to browse stablecoins confidently.

The blend from speed balance and on-strings abilities produces stablecoins exclusively suited to certain financial software you to definitely want precision and you will overall performance. Out of facilitating fast and you may sensible global purchases to enabling usage of decentralized finance (DeFi), stablecoins is actually reshaping exactly how well worth actions round the borders and you may because of financial systems. The worth of stablecoins of this kind is dependant on the new value of the newest support money, that’s kept because of the a 3rd party–regulated monetary entity.

- Por ejemplo, investors you’ll move Bitcoin on the a stablecoin such as Tether, as opposed to to your dollars.

- While the stablecoins be much more common, he’s the possibility to grow money direction alternatives within the community.

- Industry arbitrage and plays a vital role; people exploit rate inaccuracies, to shop for undervalued coins and you may selling overvalued ones, assisting to restore the newest peg.

- It price is extremely important to own go out-sensitive and painful deals and you may permits real-day percentage systems.

- Por ejemplo, USDT can be found to the Ethereum (while the an ERC-20 token) and you will Tron (while the a TRC-20 token).

Stablecoins are a variety of cryptocurrency you to try to manage a great constant well worth when it is labelled to an external investment, like the All of us dollar, euros, or silver. They have been designed to render a secure harbor from the often-unpredictable crypto market, built to blend the soundness from conventional currencies for the advantages of cryptocurrencies. 2Dakota del Norte, stablecoin issuers — expected to hold supplies inside higher-top quality quick assets such as brief-name Treasuries — can be an expanding source of need for You.S. government loans. The market industry capitalization of stablecoins provides risen up to just under 5% of the a fantastic short-term Treasury business, and that show you will increase after that, especially if overseas use bills. This could moderately help Treasury consult, helping cover productivity immediately whenever issuance is expected to keep increased.

Stablecoins serve a button part from the crypto industry, but before you get any, it is important to understand how it works. If you’ve complete the research, see the risks, and have decided you want to play with stablecoins in order to assists their crypto deals, you will want to just pick an amount you happen to be ready to lose. Remember that the brand new crypto community will likely be unpredictable, as the 2022’s TerraUSD collapse demonstrated.

Savings and you will opportunities

todavía no, the brand new impression will be limited since the those enterprises had been making preparations for a long time allow stablecoin incorporate, Faucette cards. 20 Quotes mirror wrote to your-ramp and you will away from-ramp charges away from business in addition to Transak (elizabeth.grams. on-ramp, off-ramp), MoonPay, Onramper, and you can a variety of CEXs. cuatro Centered on DeFi Llama analysis at the time of July 17, 2025, más 90% away from stablecoin have a fantastic is actually USD. Discover effortless meanings to possess popular crypto asset spending words, authored by the fresh Grayscale group. One quotes centered on prior results do not a vow coming efficiency, and you may prior to making any funding you will want to talk about your unique funding demands or talk to a professional elite.

Battle one of loan providers have stymied perform to help you interact, if you are too little standardization and you can uniform worldwide laws have eliminated the fresh development of a modern-day, international program. todavía no, we feel such incumbents is always to always innovate, whether or not this may contend with existing cash streams. Really worth drivers from established legacy payment possibilities, such ubiquity away from welcome and consumer protections, highly recommend they aren’t about to drop off. Based on current power, specific can get argue that stablecoins twist virtually no threat to incumbent commission sites. aunque no, the quantity from stablecoin purchases has expanded organically by your order of magnitude over the past few years (Showcase 1). Zero stablecoin is going to be considered one hundred% safe, since they’re all the at the mercy of dangers that come with de-pegging and you will total failure.