No products in the cart.

LegalRoids

Carter Bankshares, Inc Announces Third One-fourth 2025 Economic Overall performance County

The fresh 10 transactions sounds like a great deal, nevertheless have two months and you can everything from ACH credit, mobile consider dumps, creating genuine inspections, Zelle, debit cards orders, and you can spending bills matter. They are giving a $two hundred bucks bonus when you open an alternative Lender out of America Organization Virtue Bank-account and keep maintaining being qualified places. I problem you to come across all other organization savings account offering that kind of APY.

Other ways to get dollars away from a financial

You.S. Bank’s Height Link Charge Signature Credit also provides the newest cardholders a pleasant added bonus away from 29,one hundred thousand issues immediately after using $step one,000 for the qualified purchases inside earliest 3 months from opening the fresh account. Find – a best picks to own on the web financial institutions – is now offering up to $2 hundred to own starting the first On the internet Checking account. You’ll want to deposit $25,100000 to earn a full number, but $15,one hundred thousand just leads to a loss in $fifty.

You.S. Bank Team Essentials Examining – $400

- The bank sustained a swift demise once worries of their financial wellness lead to a rush away from depositors seeking withdraw its finance.

- There isn’t any monthly fee on the membership, and you only need $twenty five to start it.

- Advantages Checking customers along with discovered the first-order out of checks free.

- For longer-name offers, a great 3-12 months or extended Computer game may help you optimize desire.

Nonperforming property, along with finance delinquent ninety days or more, nonaccrual financing, and foreclosed possessions, enhanced of $step 3.98 million during the December 29, 2024 to $4.39 million in the September 31, 2025, a rise away from $415,000 otherwise 10.4%. Complete low-undertaking possessions had been 0.49% and 0.46% of overall possessions by Sep 30, 2025 and you will December 30, 2024, respectively. Within the increase out of non-carrying out assets try an excellent repossession out of industrial real estate property having a good value of $dos.9 million during the go out of repossession.

Fidelity Opportunities

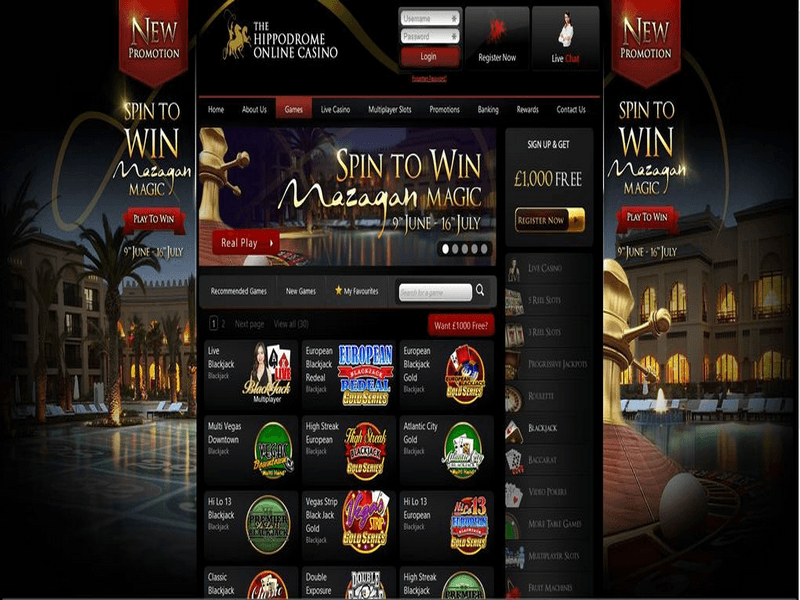

Examining account is designed for your day-to-day deals — they’ve been the place you keep currency that you will be thinking of investing. A knowledgeable checking account don’t have monthly https://happy-gambler.com/the-lost-princess-anastasia/ fees and could spend you certain focus, as well. High-produce deals accounts’ distinguishing foundation is because they earn a much higher APY than just traditional deals accounts, which can be are not offered by stone-and-mortar banking companies. Old-fashioned account tend to secure to 0.01 per cent APY, if you are highest-produce offers profile is making APYs up to 4 %. BrioDirect’s Highest-Produce Checking account now offers a competitive give, but it demands a high minimum deposit from $5,100000 to start. After you open the brand new account, you can keep less money inside if you want, but you will you would like no less than $25 to make the fresh bank’s large-yield discounts APY.

What bank will give you money for opening a bank checking account?

- Find out about how exactly we choose the best financial services the strategy to have reviewing banking institutions.

- FDIC deposit insurance simply covers dumps during the FDIC-covered financial institutions and discounts connections.

- And you also’ll secure an identical high rate for your profit your account.

- Even if their financial aids global transmits, you’ll probably rating an awful exchange rate, as well as a lot of charge—especially if the transfer encounters the brand new Quick community.

Area financial institutions’ share away from lengthened-term financing and bonds are 44.six percent inside the very first quarter 2024, off from 51.0 percent history quarter and you will a maximum of 54.7 percent inside the 4th quarter 2022. Another chart shows an average net focus margin to the world plus the four resource dimensions teams on which the brand new QBP reports. All of the advantage-proportions communities stated one fourth-over-quarter reduction in the online interest margins. The brand new banking globe went on to show resilience in the first quarter. Net income rebounded in the low-recurring expenses one to influenced income last one-fourth, asset quality metrics stayed basically favorable, as well as the community’s exchangeability is actually steady. But not, a’s net focus margin refused while the battle proceeded to help you pressure costs paid off for the places and you can resource efficiency refused.

The new cash these partnerships make provides the opportunity to shell out our very own higher team out of writers for their works, in addition to still improve the web site and its particular blogs. This amazing site are an independent, advertising-served research provider. We should help you make private fund behavior with full confidence by giving you having 100 percent free interactive equipment, useful research issues, by publishing new and mission posts. The new card does not have any annual percentage, and you can cardholders along with delight in experience such VIP seats and you can 5-star foods, among most other advantages. These always need you to spend a certain amount using your new card, and also you’lso are usually considering a few months to fulfill you to definitely needs.

The weekday, Investopedia’s team of personnel publishers and you can conformity managers song examining and you will savings account incentives out of 24 banking institutions to get people with a knowledgeable Roi. We rank a knowledgeable bonuses in accordance with the count, requirements to earn the main benefit, and account info and constraints. As much of you probably know, for the March ten, 2023, SVB, having $209 billion inside the assets from the 12 months-prevent 2022, try signed because of the county banking authority, just who designated the newest FDIC while the receiver. Following, to the Thursday, February 9, offers from SVB dropped 60 percent, and it educated a rush by uninsured depositors.

It’s the 2nd covering of cash we deploy a lot more than a bank account. Pursuing the Provided lowers rates, we could predict high-produce deals profile to help you pattern downward. But not, they’lso are nonetheless a great services for many because the making some funds to your $fifty, $a hundred, otherwise $200,100000 inside deals is preferable to earning not one if it’s kept in a checking account. Openbank now offers an individual membership — an enthusiastic FDIC-covered bank account who may have a premier-notch annual commission produce (APY). There are not any month-to-month costs, which is normal from online banks, but there is however at least starting deposit element $500.

Direct put is a help in which monitors is actually immediately placed to your users’ bank accounts. Applying for lead deposit generally requires the account holder to accomplish a form, possibly on line, from the a branch otherwise at the their employer (to own payroll places). Asterisk-100 percent free Examining, the financial institution’s most elementary family savings, doesn’t have monthly maintenance commission with no minimum put needs. Huntington Rewards Checking and you may Huntington Rare metal Advantages Examining are each other desire-impact checking profile.

Huntington Unlimited Organization Checking – $400

The next option would be focused coverage with assorted levels of put insurance coverage for several kind of profile. In particular, it would focus on higher visibility accounts for team payment membership. Business percentage accounts can get perspective less danger of ethical risk since the the individuals customers try less likely to consider their dumps playing with a danger-come back tradeoff than just a good depositor by using the account for savings and money objectives. Meanwhile, business percentage membership could possibly get twist higher financial balance issues than many other profile as the the shortcoming to get into these types of profile can result inside the wider monetary effects. Chase is among the biggest banking institutions regarding the U.S. and one of the best federal banking institutions. Chase checking profile offer solid entry to financial services in person an internet-based, and lots of account offer an indication-upwards added bonus.

Recent supervisory work provides concerned about determining write off window operational maturity because of the ensuring that court and you will working data files is actually most recent, obligations are-laid out, and research is carried out because the appropriate. At the same time, administrators are examining the brand new sufficiency away from pre-sworn security and also the maneuverability extra guarantee to the Discount Screen offered possible money demands while in the fret. From the you to definitely nights, $42 billion in the places got remaining the lending company with a supplementary $a hundred billion staged to be taken the very next day.

The brand new $5.dos billion program revealed inside 2021 to help Californians lower local rental loans it obtained within the pandemic. Although it prevented getting the brand new applications in the 2022, more than 70,100 properties have apps pending. The applying features enough financing to fund more than simply 14,one hundred thousand anyone — meaning the remainder 80% of your overall candidate pond is beyond chance. “The lending company not should have POD regarding the membership name or even in its information provided the brand new beneficiaries is actually indexed somewhere in the bank facts,” Tumin told you. For each and every beneficiary of the believe may have a great $250,one hundred thousand insurance rates limit for as much as four beneficiaries. But not, if the there are other than just four beneficiaries, the newest FDIC visibility limit to your trust account remains $step 1.twenty five million.